Medicare, the federal health insurance program, serves as a critical lifeline for millions of Americans, primarily those aged 65 and older, as well as certain younger individuals with disabilities. Understanding Medicare can be complex due to its various parts and coverage options. This article aims to demystify Medicare insurance, exploring its components, eligibility requirements, enrollment processes, and the benefits it offers.

What is Medicare?

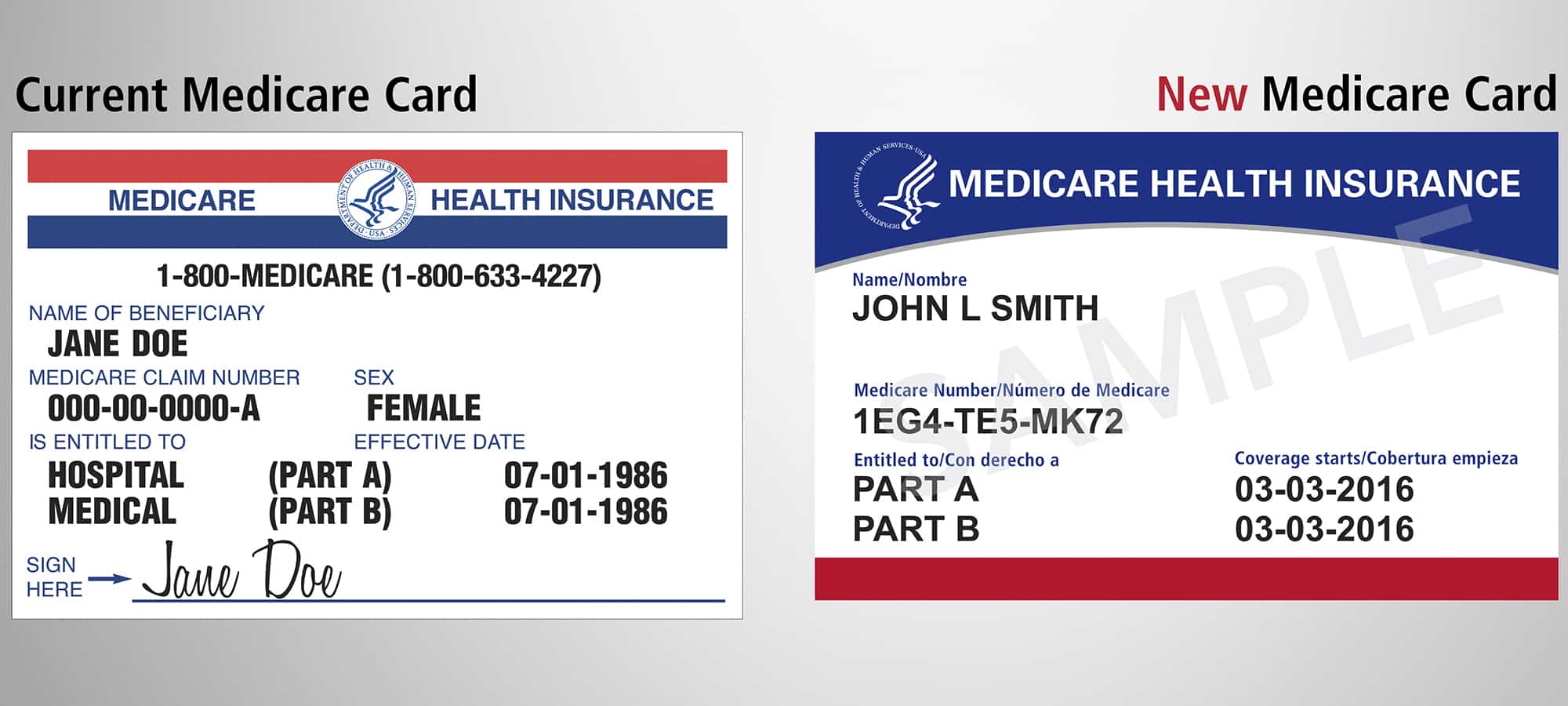

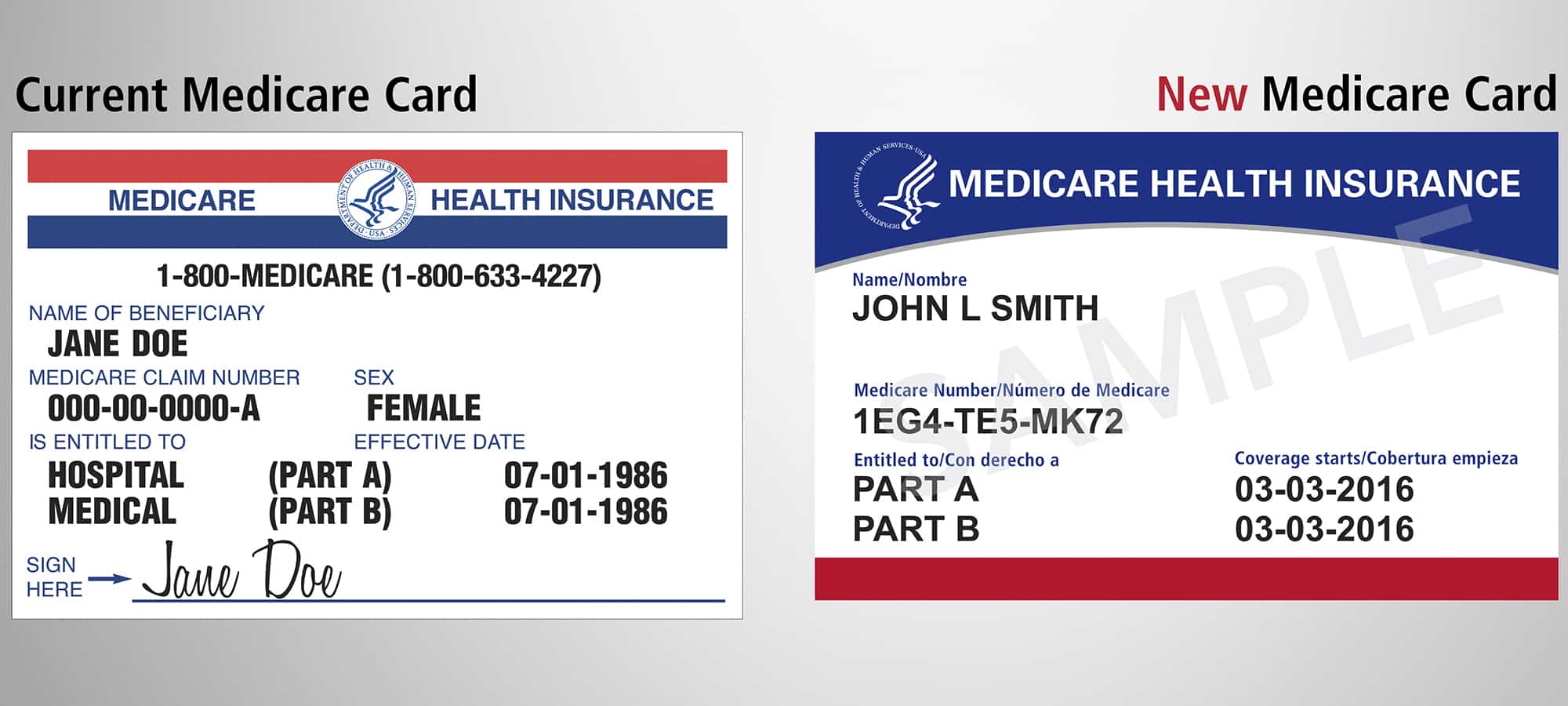

Medicare is a federal health insurance program established in 1965 under the Social Security Act. It is designed to provide affordable health care coverage for older adults and certain younger individuals with disabilities. Medicare consists of several parts, each covering different aspects of health care.

The Four Parts of Medicare

- Medicare Part A (Hospital Insurance):

- Coverage: Inpatient hospital stays, skilled nursing facility care, hospice care, and some home health care.

- Cost: Most people do not pay a premium for Part A if they or their spouse paid Medicare taxes while working. However, there are deductibles and coinsurance costs.

- Medicare Part B (Medical Insurance):

- Coverage: Doctor visits, outpatient care, preventive services, and medical supplies.

- Cost: Part B requires a monthly premium, which varies based on income. There are also deductibles and coinsurance.

- Medicare Part C (Medicare Advantage):

- Coverage: Part C plans are offered by private insurance companies and provide all Part A and Part B benefits. Many plans include additional benefits like prescription drug coverage, vision, dental, and hearing services.

- Cost: Premiums for Part C plans vary, and enrollees still pay the Part B premium.

- Medicare Part D (Prescription Drug Coverage):

- Coverage: Helps cover the cost of prescription drugs.

- Cost: Part D plans require a monthly premium, which varies by plan and income. There are also deductibles and copayments.

Eligibility for Medicare

Eligibility for Medicare primarily depends on age, but there are other qualifying criteria:

- Age: Individuals aged 65 or older are eligible for Medicare.

- Disability: Younger individuals with certain disabilities who have received Social Security Disability Insurance (SSDI) for 24 months.

- Specific Conditions: Individuals with End-Stage Renal Disease (ESRD) or Amyotrophic Lateral Sclerosis (ALS) are eligible for Medicare regardless of age.

Enrollment Process

- Initial Enrollment Period (IEP): This seven-month period begins three months before the month you turn 65, includes your birth month, and ends three months after your birth month. During this time, you can enroll in Medicare Part A and/or Part B.

- General Enrollment Period (GEP): If you miss your IEP, you can enroll in Part A and/or Part B during the GEP, which runs from January 1 to March 31 each year. Coverage begins July 1, and late enrollment penalties may apply.

- Special Enrollment Period (SEP): If you are still working and covered by an employer’s health plan, you may qualify for a SEP to enroll in Part A and/or Part B without penalty when your employment ends.

- Medicare Advantage and Part D Enrollment: After enrolling in Parts A and B, you can choose to enroll in a Medicare Advantage plan or a Part D plan during your IEP, the Annual Election Period (October 15 to December 7), or during a SEP if you qualify.

Benefits of Medicare

- Comprehensive Coverage: Medicare provides extensive coverage for hospital stays, medical visits, and prescription drugs, helping to reduce the financial burden of healthcare costs for older adults and individuals with disabilities.

- Preventive Services: Medicare covers many preventive services, such as screenings, vaccines, and wellness visits, at no additional cost, promoting early detection and prevention of serious health conditions.

- Choice and Flexibility: With Medicare Advantage plans, beneficiaries have access to additional benefits and the flexibility to choose plans that best meet their healthcare needs and budgets.

- Financial Protection: Medicare helps protect against high medical costs, providing a safety net for beneficiaries with chronic conditions or those requiring long-term care.

Challenges and Considerations

While Medicare offers substantial benefits, there are also challenges and considerations:

- Out-of-Pocket Costs: Beneficiaries are still responsible for premiums, deductibles, copayments, and coinsurance, which can add up, especially for those with limited income.

- Complexity: Navigating Medicare’s various parts and enrollment periods can be complex and confusing, requiring careful consideration and planning.

- Coverage Gaps: Original Medicare (Parts A and B) does not cover all healthcare expenses, such as dental, vision, hearing aids, and long-term care. Many beneficiaries purchase supplemental insurance (Medigap) or Medicare Advantage plans to fill these gaps.

Conclusion

Medicare is a vital program that provides essential health care coverage to millions of Americans. Understanding its parts, eligibility, enrollment process, and benefits can help individuals make informed decisions about their healthcare. Despite its complexities and challenges, Medicare remains a cornerstone of health care security for older adults and individuals with disabilities, offering comprehensive coverage and financial protection. As the population ages, the importance of Medicare will only continue to grow, making it essential for beneficiaries to stay informed and make the most of their coverage options.

Medicare Part C, also known as Medicare Advantage, is an alternative to Original Medicare (Part A and Part B) that offers additional benefits and is provided by private insurance companies approved by Medicare. These plans bundle Part A (hospital insurance) and Part B (medical insurance), and often include additional coverage such as prescription drugs, vision, dental, and hearing services. Here’s a comprehensive look at what Medicare Part C entails.

What is Medicare Part C?

Medicare Part C, or Medicare Advantage, is a type of Medicare health plan offered by private insurance companies that contract with Medicare to provide all Part A and Part B benefits. These plans often come with extra benefits not covered by Original Medicare and may include Part D (prescription drug coverage).

Key Features of Medicare Part C

- Comprehensive Coverage:

- All-in-One Plans: Medicare Advantage plans provide all the coverage of Parts A and B and often include additional benefits like dental, vision, hearing, and wellness programs.

- Prescription Drug Coverage: Many Medicare Advantage plans also include Part D coverage, which helps pay for prescription medications.

- Cost Structure:

- Premiums: Beneficiaries usually pay a monthly premium for the Medicare Advantage plan in addition to the Part B premium.

- Cost-Sharing: Plans often have different out-of-pocket costs, including copayments, coinsurance, and deductibles. However, they are required to set an annual limit on out-of-pocket expenses for covered services, which can protect beneficiaries from high costs.

- Provider Networks:

- Network Restrictions: Medicare Advantage plans often use networks of doctors, hospitals, and other health care providers. Enrollees may need to use the plan’s network to get the lowest costs.

- Types of Plans: Common types of Medicare Advantage plans include Health Maintenance Organizations (HMOs), Preferred Provider Organizations (PPOs), Private Fee-for-Service (PFFS) plans, and Special Needs Plans (SNPs).

- Extra Benefits:

- Additional Services: Many plans offer extra benefits such as routine dental care, eye exams, hearing aids, and fitness programs like gym memberships.

- Wellness Programs: Some plans include wellness and preventive services, such as nutrition counseling, smoking cessation programs, and other health management services.

Eligibility and Enrollment

- Eligibility:

- You must be enrolled in both Medicare Part A and Part B.

- You must live in the service area of the Medicare Advantage plan you want to join.

- Enrollment Periods:

- Initial Enrollment Period (IEP): This is the seven-month period around your 65th birthday (three months before, the month of, and three months after your 65th birthday).

- Annual Election Period (AEP): From October 15 to December 7 each year, during which you can join, switch, or drop a Medicare Advantage plan.

- Medicare Advantage Open Enrollment Period: From January 1 to March 31 each year, during which you can switch to a different Medicare Advantage plan or return to Original Medicare.

- Special Enrollment Periods (SEPs): You may qualify for a SEP if you move out of your plan’s service area, lose other insurance coverage, or experience other specific life events.

Advantages and Disadvantages of Medicare Part C

Advantages:

- Bundled Coverage: Combines hospital, medical, and often prescription drug coverage into one plan.

- Additional Benefits: Offers extra services not covered by Original Medicare.

- Out-of-Pocket Maximum: Limits annual out-of-pocket expenses for covered services, providing financial protection.

Disadvantages:

- Network Restrictions: May require you to use the plan’s network of providers for the lowest costs.

- Plan Variability: Coverage, costs, and provider networks can vary significantly from plan to plan and by location.

- Prior Authorization: Some services may require prior authorization, adding an extra step before receiving care.

Conclusion

Medicare Part C, or Medicare Advantage, offers an alternative to Original Medicare with additional benefits and potentially lower out-of-pocket costs. However, it’s important to carefully compare plans based on coverage, costs, provider networks, and additional benefits to find the one that best meets your health care needs. By understanding the key features and evaluating your options, you can make an informed decision about whether Medicare Part C is the right choice for you and Medfix billing services.

Leave a Reply